Let's Make a Difference with Solar

Solar Power

With the climbing costs of electricity and the ongoing cost-of-living crisis, transitioning to solar power for your home is an increasingly obvious choice.

Solar power gives you the chance to lock in a low energy rate permanently. When you go solar, you set a fixed, low rate for your power. No more unexpected bill spikes! Plus, going solar instantly lowers your power bill since your solar system provides energy that you no longer have to buy from your utility company.

Why Solar Power?

Solar is More Affordable than Ever!

As technology advances, solar systems are becoming more efficient, more affordable, and more durable than ever before. When financed, solar energy systems can cost the same amount as your current electric bill – or even reduce energy costs – and allow you to own your home’s power source.

Solar also works excellently when paired with energy efficiency. Energy efficiency reduces the amount of energy your home uses. That means you need less solar panels to provide the amount of power your home needs, making solar even easier on your pocket.

Net Metering

Any excess power produced by your solar system will be sent back to the grid as “banked” energy for you to pull from in the evening and less sunny days.

Solar Renewable Credit

Earn money from your solar system by selling SRECs to utilities or energy suppliers to meet their renewable energy compliance requirements.

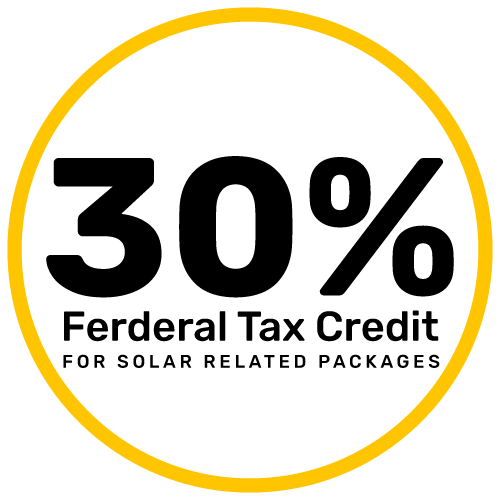

Federal Tax Credit

Utilize a 30% federal credit for your renewable energy project and anything bundled.

Reduce Your Environmental Impact

Switching to solar has a positive impact on the environment. American households, on average, use around 10,000+ kilowatt hours (kWh) annually to power their homes. At Earth Right Mid-Atlantic, we help provide a way for you to reduce your household’s environmental impact through solar and energy efficiency.

Take Control of your power

If you take the leap from renting a home to owning a home, you make a decision that will allow you to start investing in yourself and your future in a new way. The same is true of going solar – you can keep paying the power company for the electricity your home consumes, or you can invest in a solar energy system that will produce electricity for you and provide energy independence to your home.

With Solar, You Can

Take Control of

Your Power

If you take the leap from renting a home to owning a home, you make a decision that will allow you to start investing in yourself and your future in a new way. The same is true of going solar. You can keep paying the power company for the electricity your home consumes, or you can invest in a solar energy system that will produce electricity for you and provide energy independence to your home.

Additional Features

Generac Battery Backup

SolarEdge Battery Backup

SolarEdge Electric Car Charger

Call 434-200-9716 to speak to a consultant to learn more information

How Solar Power Works for You

We all have a power bill. Why not take the payments that you make towards your power company, and put those payments towards owning your power and creating energy independence in the years to come?

Don't Miss The

Incentives for Solar Power Today

There has never been a better time to go solar!

If you pay taxes, you may qualify for the 30% federal tax credit provided to homeowners who go solar. You can put this credit directly into your pocket, or put it towards financing and paying off your solar system.

We can also help review additional local and federal programs you could benefit from when you switch to solar power.

Incentives for Solar Today

There has never been a better time to go solar!

If you pay taxes, you may qualify for the 30% federal tax credit provided to homeowners who go solar. You can put this credit directly into your pocket, or put it towards financing and paying off your solar system down the road.

We can also help review any additional local and federal programs you could benefit from when you switch to solar.

Partners and products

Partners and products

The Process Begins with an Assessment

Let’s see if solar power or energy efficiency could be a good option for you. With a no-cost assessment, we can talk about your goals, check your roof, and assess your current energy bill to see what you could save.